Stock Support and Resistance

Topics

- Price areas

- Types and strength

Price areas

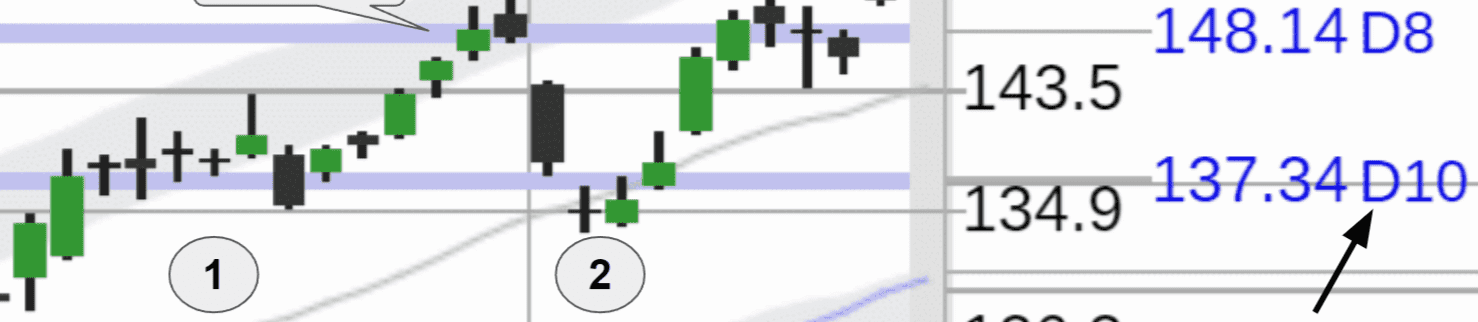

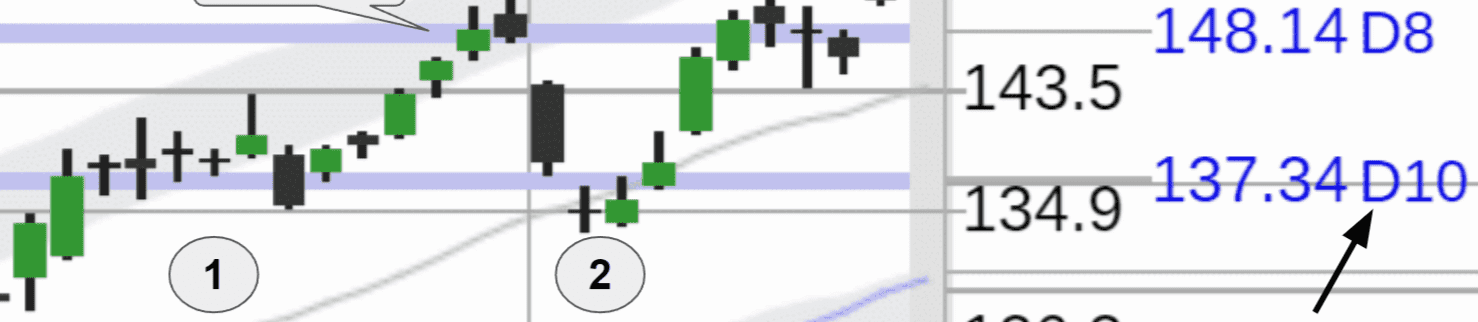

- Stock support is a price area at or below the current price, which provides support against any downward movement. The stock may pull back to support, labeled as blue lines on the 8 month chart.

- Stock resistance is a price area at or above the current price, which provides resistance against any upward movement. The stock may rally to resistance, labeled as red lines on the 8 month chart.

- A neutral "support or resistance" price area provides both resistance from upward movement

and support from downward movement and is labeled as grey lines on the 8 month chart.

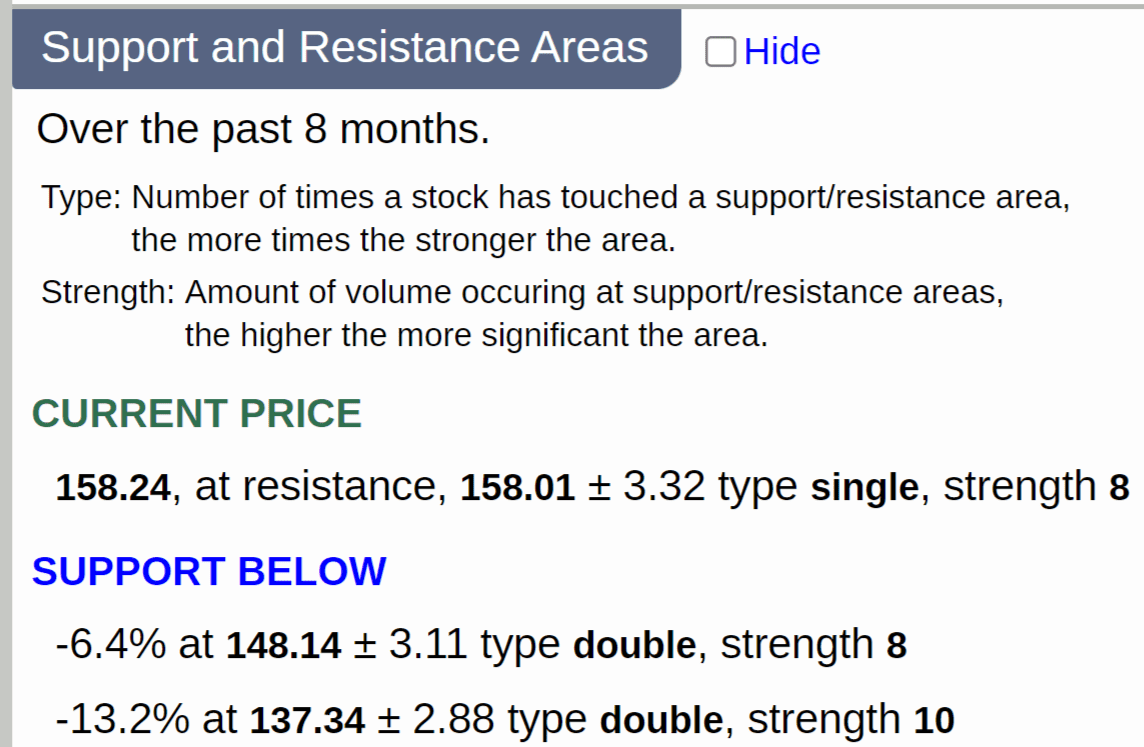

Types and strength

- Support and resistance areas have a (+ and -) width in stock points.

- The type refers to the number of times a stock bounced off support or rejected resistance areas over the past 8 months (Single=1 time, Double=2 times, Triple=3 times, Triple+= more than 3 times); the more times, the stronger the support or resistance area.

The types vary from the weakest Single (S), Double (D), and Triple (T) to the strongest Triple (T+) and are labeled S, D, T, and T+ on the stock chart.

- Each area has a strength that varies from 1-10. This number represents the

total stock accumulation or distribution volume in each area.

- Weak support and resistance areas created with light distribution or accumulation volume have strength from 1-3.

Double support example

Double support example

Disclaimer: This is NOT investment advice, just general help and opinions. Please check with a registered investment

advisor before making any investment decisions. This

document may contain errors. Chapman Advisory Group LLC employees are not investment advisors. Please review:

https://www.stockconsultant.com/disclaimerpage.html